Bitcoin dropped below $104,000 on Tuesday, but Arthur Hayes says it’s too early to cue the dirge of the top crypto.

While the asset’s price slumped 27% in the last month, the chief investment officer at Maelstrom argued in a Tuesday essay that the Federal Reserve will trigger a new rally.

Bitcoin’s next chapter will begin once the US central bank quietly slips into stealth quantitative easing, a liquidity reboot disguised as policy prudence, Hayes said. But for now, the markets are choking on the liquidity drain caused by the US government’s shutdown.

“Given that the four-year-cycle anniversary of the 2021 Bitcoin all-time is nigh,” he wrote, “many will mistake this period of market weakness and ennui as the top and dump their stack. That is a mistake.”

Even so, the BitMEX founder says he cannot time the trigger that will reignite the market.

Fed Chair Jerome Powell vowed that quantitative tightening, the opposite of quantitative easing, will cease by December 1, but there aren’t any guarantees of another interest rate cut next month.

The CME FedWatch tool currently places the odds of another rate cut at 72%, but analysts warn that uncertainty could weigh on the big decision to further slash rates.

Uncertainty from the Fed has led to a 10% decline in Bitcoin’s value over the last week, as outflows from spot Bitcoin exchange-traded funds have nearly reached $1 billion during this period.

Hayes advised investors to conserve their capital and weather the choppy market until the shutdown is resolved. He previously predicted that Bitcoin could reach at least $200,000 before the end of the year.

Bitfinex analysts stated that the market is in a “fragile equilibrium” and that a capitulation is possible unless Bitcoin’s price recovers significantly, according to comments shared with DL News.

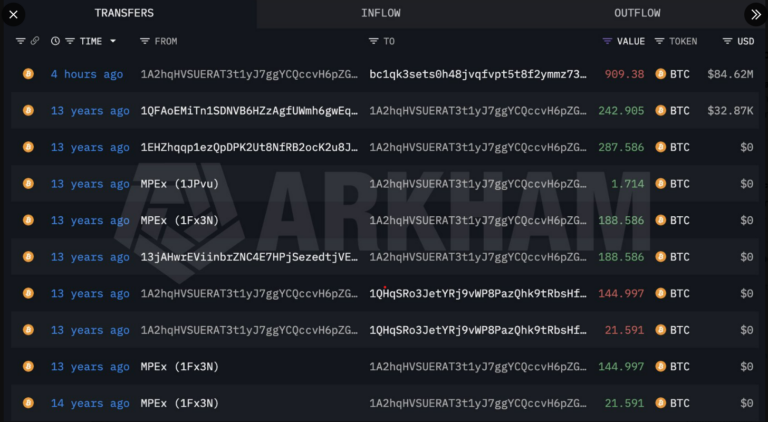

They blamed persistent selling from so-called long-term holders for Bitcoin’s current price decline.

Market data from CryptoQuant indicates that long-term holders sold more than 827,000 Bitcoins worth approximately $86 billion in the last 30 days. That’s almost 4% of the Bitcoin supply sold last month, and is the largest monthly drawdown for Bitcoin since July.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.