Berachain executed a rapid hard fork to protect users, while Sonic Labs froze the attacker’s wallet to stop further losses. But the damage had already rippled through the system.

xUSD depegs as Stream Finance’s popular yield-bearing token loses stability. The event exposes deeper questions about leverage, transparency, and risk management in DeFi’s complex infrastructure.

How the Balancer Exploit Triggered a Chain Reaction

A hacker exploited a vulnerability in Balancer v2 across several blockchain networks. For hours, it remained unclear which liquidity pools were compromised or which DeFi platforms had direct exposure. That uncertainty triggered panic withdrawals as investors scrambled to safeguard funds.

1/ TL;DR

Hours after a multichain @Balancer exploit triggered widespread uncertainty across DeFi, @berachain executed an emergency hard fork, and @SonicLabs froze the attacker’s wallet.

Shortly after, Stream Finance’s xUSD began to depeg materially below its target range. pic.twitter.com/FG0T9SgGKj

— Omer Goldberg (@omeragoldberg) November 3, 2025

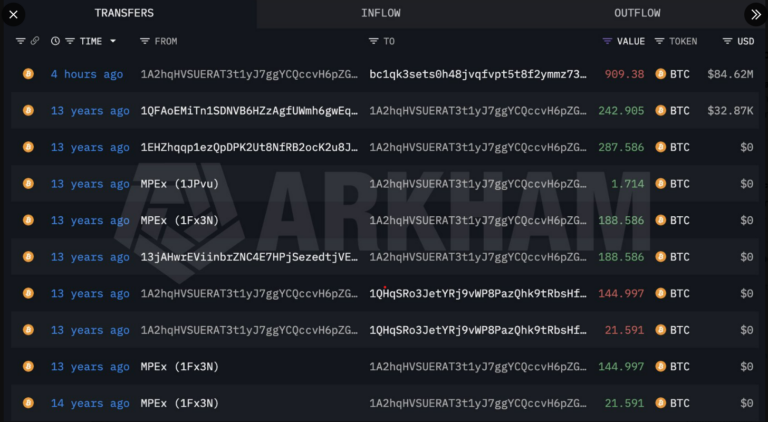

Stream Finance, which operates as an on-chain capital allocator managing user deposits through high-yield strategies, was among those affected. Lacking a full transparency dashboard or a robust Proof of Reserve system, the protocol struggled to reassure users. As fear spread, xUSD—a tokenized dollar product designed to stay near $1.26—dropped as low as $1.15 before recovering slightly to $1.20.

3/ What Happened & Backdrop

A Balancer v2 exploit unfolded across several chains, and for an extended period, it was unclear which pools were affected on which networks or which integrated protocols had direct exposure.https://t.co/4moExth8QM

— Omer Goldberg (@omeragoldberg) November 3, 2025

This kind of “reflexive stress event,” where uncertainty itself causes rapid withdrawals and price declines, mirrors the behavior seen in traditional bank runs. Stream Finance’s leveraged structure amplified the stress, as its assets were used as collateral across multiple lending protocols on Arbitrum, Plasma, and other networks.

Some markets avoided instant liquidations because they rely on fixed “fundamental value” feeds rather than live market prices. While this design helps prevent flash liquidations, it can also obscure real-time risk, delaying necessary corrections.

6/ Stream is an on-chain capital allocator that runs high-reward, high-risk strategies with users’ funds.

Its portfolio construction has carried meaningful leverage, making the system more resilient under stress, and in recent days, the protocol has been at the center of a… pic.twitter.com/mB3Ce9j2Xi

— Omer Goldberg (@omeragoldberg) November 3, 2025

The Bigger Picture: Transparency and Trust in DeFi

The episode highlights a recurring issue in decentralized finance: the tension between innovation and transparency. Many DeFi projects, in pursuit of higher yields, take on structural risks that are not fully visible to users. Without comprehensive Proof of Reserve audits and transparent portfolio reporting, investors are left guessing how safe their assets truly are.

According to DefiLlama, total value locked (TVL) across DeFi dropped by 4% within 24 hours of the Balancer exploit, underscoring how quickly fear spreads in a system built on interconnected protocols. Recent collapses, from Terra’s stablecoin in 2022 to Curve’s July 2024 hack, show how liquidity crises can snowball when confidence falters.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Balancer Exploit Sparks DeFi Panic as xUSD Depegs appeared first on Altcoin Buzz.