Trump announced 100% tariffs on China.

- Nasdaq plunged 3.5%

- S&P 500 fell 2.7%

- $1.5 trillion wiped out from the stock market

Historic $18.5B Crypto Liquidation Shakes the Market

October 10th also marks the largest liquidation event in the history of cryptocurrency.

- $16 billion worth of longs liquidated

- $2.5 billion worth of shorts liquidated

The worst part?

- Binance stopped working

- Coinglass stopped working

- Hyperliquid stopped working

This meant that stop loss calls could not be triggered, and all positions got wiped out. Market makers pulled liquidity from exchanges, and DeFi struggled because of forced liquidations.

We have some theories about how it happened. But for the sake of keeping everything nice and tidy, let’s not dive into such theories. This shows how centralized the crypto world actually is. Centralized Exchanges, Market Makers, and policymakers are working in harmony to drown the market.

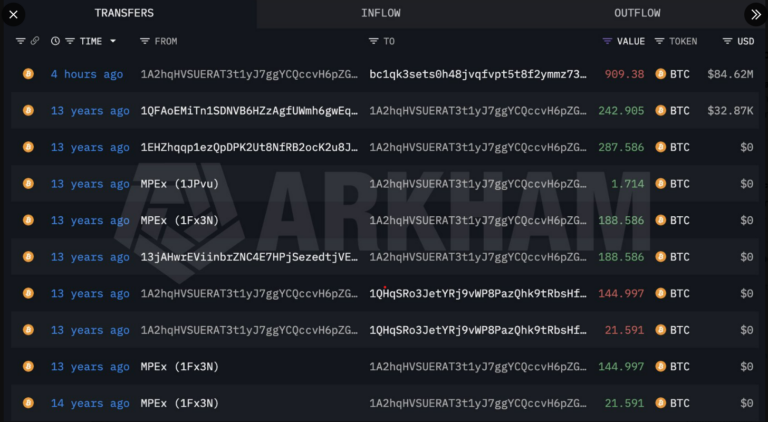

You can find countless tweets about how some whales shorted the market before the collapse, with freshly created wallets. Let me assure you of one thing — it does not matter; don’t make it a mission to find out what really happened.

If you are hurt, liquidated, and feeling sorry, I understand. I am also hurt. My portfolio also drowned. Everyone is suffering. The well-coordinated manipulation is just ahead of the CPI and interest rate revision scheduled on 15th October. There is a 93% chance that an interest rate cut will happen. Take a look at the Fear and Greed chart.

Towards the end of September, the sentiment was extreme fear. 1 week later, the sentiment was Greed. Another week, and the sentiment hit Extreme Fear again.

This level of volatility was normal from 2014 to 2017, when the liquidity was too low and the spread was too thin. But this is 2025, with a growing Bitcoin ETF and many regulated exchanges.

Now, what is the future?

Remember this chart we published in September? We had identified $102k as the target for Bitcoin in September. This level had huge liquidity gaps and onchain order book support.

However, due to the macro support from the interest rate cut, this scenario did not play out in September.

October started in a bullish tone. So, we thought maybe this low will be revisited in the bear market, in the future. However, it was unfortunate that such a crash happened in the most bullish month!

What may happen next?

Bitcoin is responding well to the crash. It is at $115k already. For spot holders, the volatility has no impact on their holdings as Bitcoin recovered well.

October rate cut could bring further bullishness.

Nevertheless, such crash targets get revisited almost always.

Take a look at the crash of December 2024. Even though Bitcoin had some bullish momentum, the target was revisited soon.

The two crashes in April 2024 were retested in May 2024.

The March 2024 crash target was also retested in April and May 2024.

The August 2023 crash target was also retested.

This means 102k is also going to be retested. We do not know when.

Usually, the retest happens in a month. If the target is not retested in three months, the target becomes the bear market target. It is as simple as that.

So, we can expect a retest of $102k in November. Until that retest, things will be bullish and accumulating. Also, the November retest is likely to be a slow bleed in a week. For example, in the third week of November, Bitcoin drops 2% on Monday, 3% on Tuesday, etc.

The cycle reset will happen on a later date. We will reveal the target later.

That is all for now. Ignore the bullish noise on October 15. DCA into strong alts. Be systematic in your approach. Rest assured, the bear market has not started yet.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies presented are the thoughts and opinions of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments; therefore, please conduct your due diligence. Copyright Altcoin Buzz Pte Ltd

The post Crypto Market Report – October 13th 2025 appeared first on Altcoin Buzz.