Chainalysis has released its 2025 Global Crypto Adoption Index, and the results show a striking shift in mainstream crypto adoption.

The 2025 Chainalysis report ranks India as the leading nation in terms of crypto adoption, and a notable climb for the United States following significant policy changes and support from President Donald Trump.

The report also shows that several factors drive crypto adoption in 2025; grassroots retail engagement and institutional momentum. Here’s a dive into the core part of the research

🌏 The Chainalysis 2025 Global Cryptocurrency Adoption Index is L I V E!

Here’s a snapshot of what we found:

🔹APAC is emerging as the fastest-growing region

🔹Eastern Europe countries dominate the index, when adjusted for population

🔹 Stablecoins are surging globally for a… pic.twitter.com/XGdbscCq48— Chainalysis (@chainalysis) September 3, 2025

India Leads with Grassroots Strength

India’s position at the top comes as no surprise to close watchers of the region. Despite regulatory uncertainty, retail users have embraced crypto at scale, with activity spanning from trading and savings to gaming and payments.

Chainalysis notes that India scores strongly across all categories in the index, underlining just how broad-based its crypto ecosystem has become. In practice, crypto in India is less about speculation and more about access, giving millions of people financial tools beyond what traditional banks provide.

U.S. Gains from Institutional Activity

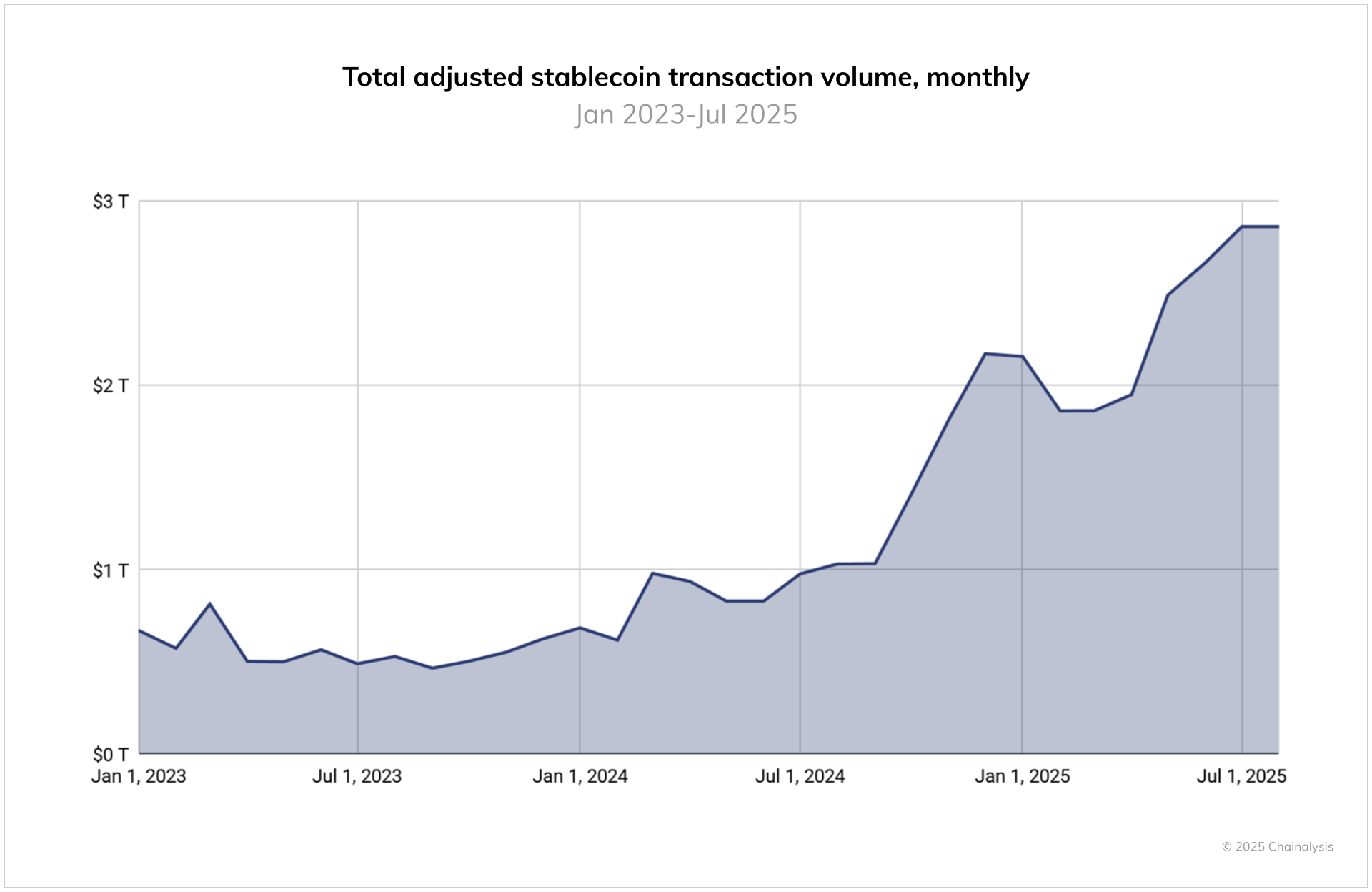

The United States’ rise in the index has a very different driver. Institutional capital is flowing into crypto at unprecedented levels, helped by the approval of spot Bitcoin ETFs and the expanding role of stablecoins in payments and trading.

Rather than grassroots adoption, the U.S. gains its strength from large-scale market players and regulated products. This signals a maturing landscape where crypto is being integrated into mainstream finance. This is a development that could reshape the global narrative.

Top 10 Countries in the 2025 Index

The Chainalysis rankings reveal the countries leading the charge in crypto adoption:

- India

- Vietnam

- United States

- Ukraine

- Philippines

- Nigeria

- Pakistan

- Brazil

- Indonesia

- Thailand

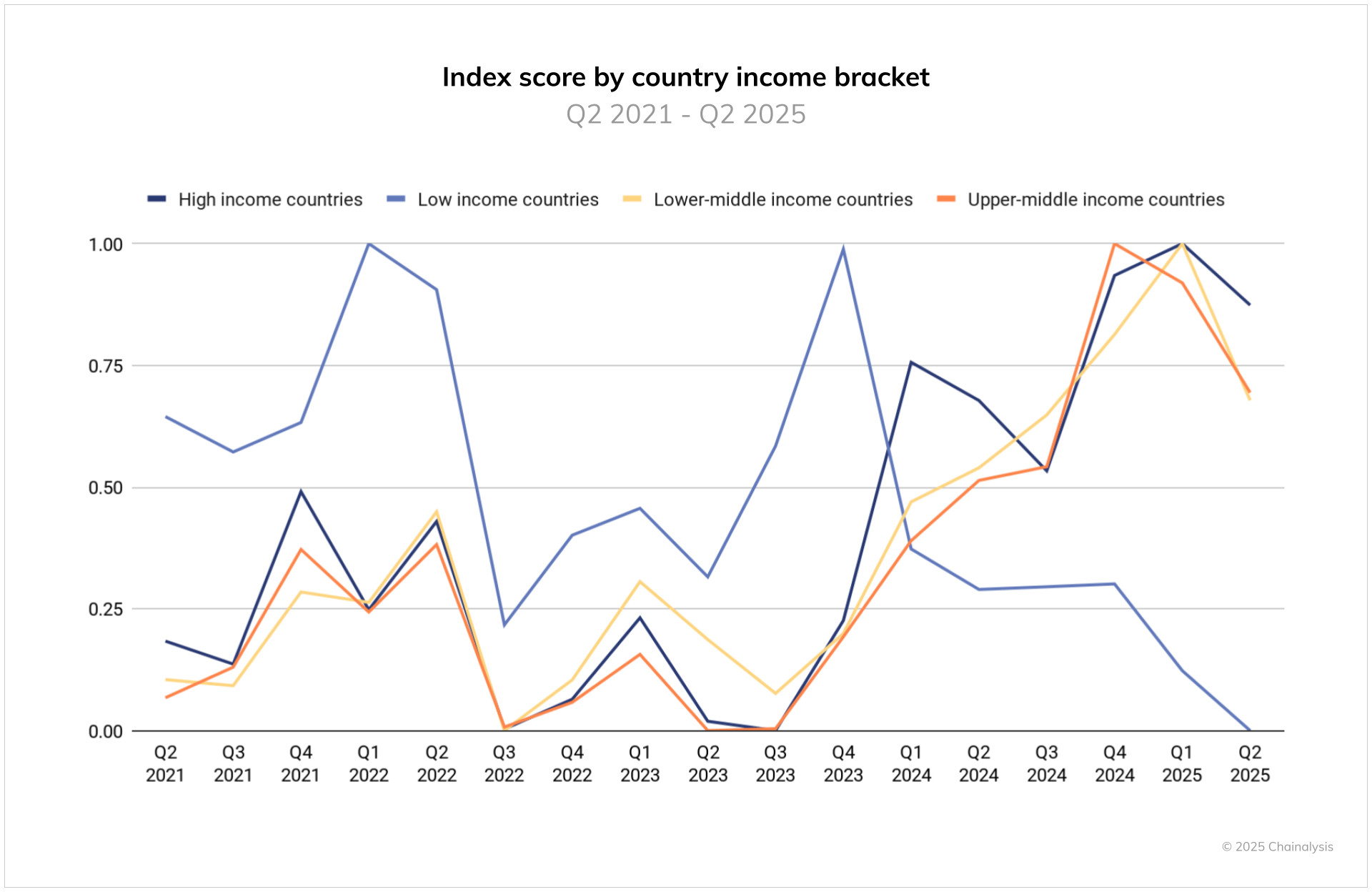

This mix shows how crypto serves vastly different purposes depending on the market. For example, while India and the U.S. are driven by scale and structure, countries like Vietnam and Nigeria thrive on grassroots adoption, where crypto powers remittances, savings, and day-to-day transactions.

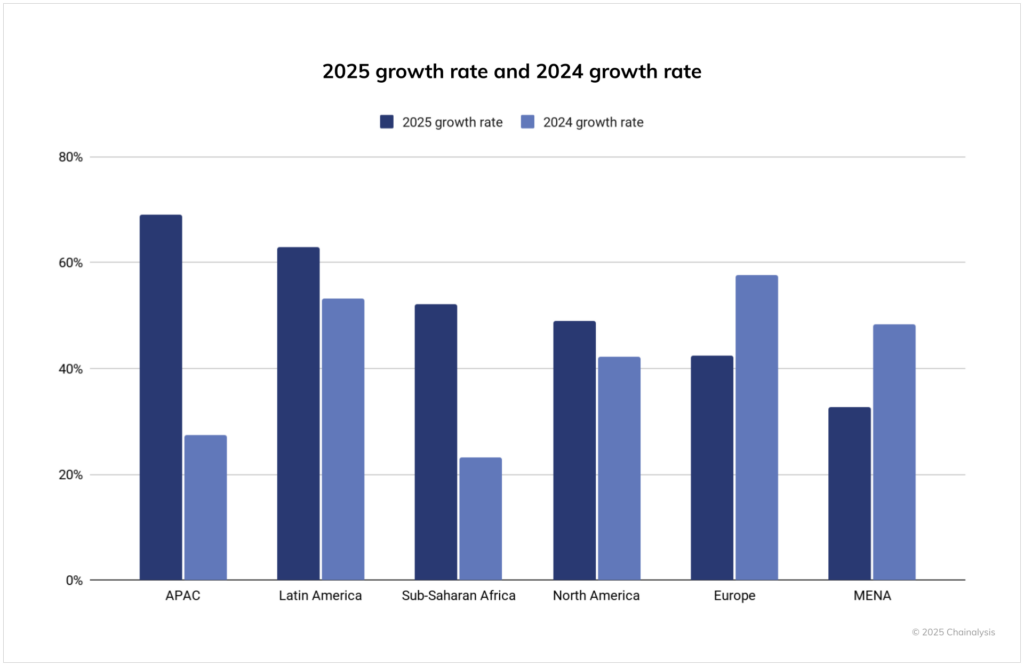

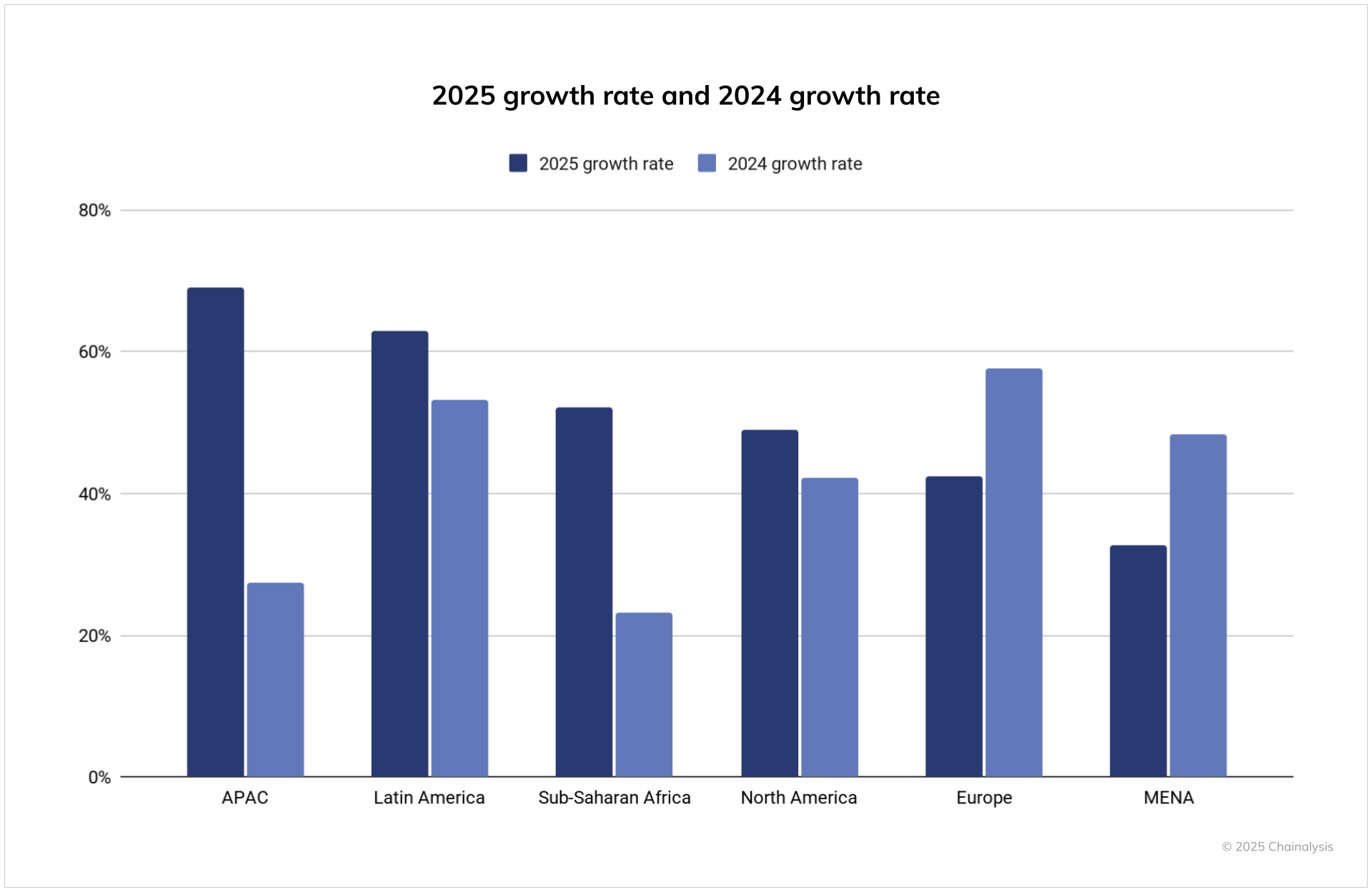

Regional Growth Momentum

Looking at broader regional trends, the numbers show that crypto adoption is tilting heavily toward the Global South. Asia-Pacific led the charge with a 69% jump in on-chain activity year-over-year, pushing total transaction volume from $1.4 trillion to $2.36 trillion

This growth is powered by key markets like India, Vietnam, and Pakistan, where retail activity dominates. Latin America followed closely with 63% growth, driven by both retail users and institutional flows.

Meanwhile, Sub-Saharan Africa recorded a 52% increase, underscoring its continued dependence on crypto for remittances and payments in economies facing inflation and currency volatility. Together, these regions highlight how utility-driven adoption is reshaping the global crypto map.

What the 2025 index makes clear is that adoption looks very different across the world. In some places, it’s about survival and access, while in others, it’s about innovation and financial integration.

Bottom Line

The latest Chainalysis index highlights crypto’s dual engines of growth: retail participation in emerging markets and institutional infrastructure in developed economies.

India’s grassroots enthusiasm and America’s financial clout show that crypto is not moving in one direction but expanding on multiple fronts. The big question for 2026 will be how regulation and innovation shape these two paths of adoption, and whether they continue to converge.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post 2025 Crypto Global Index by Chainalysis: India, US Rise appeared first on Altcoin Buzz.