Thailand is on the list of crypto-friendly countries. For example, it has a regulated cryptocurrency exchange market. It also recently implemented changes in tax exemptions for individuals holding crypto assets. However, income from those assets is still taxable. Now it has added the opportunity to buy tokenized government bonds. They go for as little as $3.

So, what are these tokenized bonds in Thailand all about?

Tokenized Bonds in Thailand

The Ministry of Finance in Thailand plans to launch $150M worth of digital “G-tokens”. It aims for both institutional and retail investors. This makes tokenized government bonds accessible to Thai citizens.

Thailand is set to issue B5 billion in investment tokens, marking a significant step in the country’s financial innovation. The tokens will be available to both institutional and retail investors, aiming to boost economic growth and attract global investment. The initiative is… pic.twitter.com/4IUuqpgsCn

— Bangkok Post (@BangkokPostNews) May 13, 2025

Here are some more details regarding these tokenized bonds,

- G-tokens start at only $3. They’re available to Thai residents.

- The tokenized bonds are regulated but are not crypto. More on this in a moment.

- They are tradable on licensed digital asset platforms.

- Aimed at higher yields than standard bank deposits. Commercial banks in Thailand currently offer 1.25% for a 12-month deposit.

This reflects a big change for Thai retail about tokenized bonds. They had limited or no access to large investment product offerings. In Thailand, these are in general for institutional or wealthy investors.

The Difference Between G-Tokens and Crypto

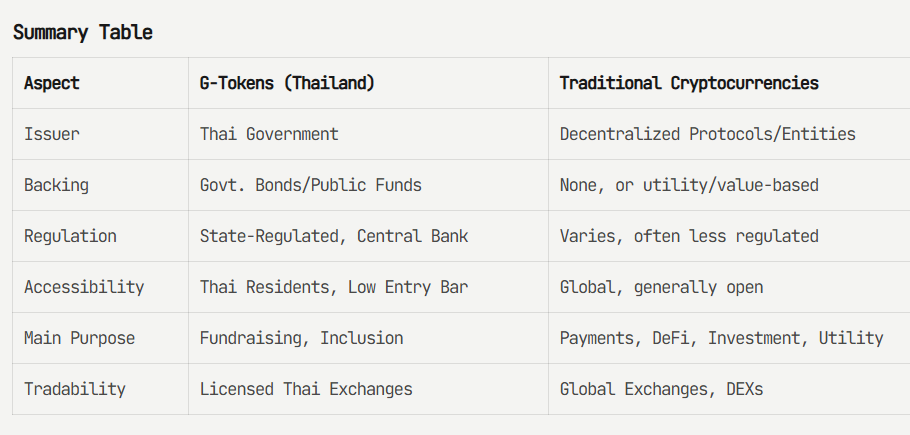

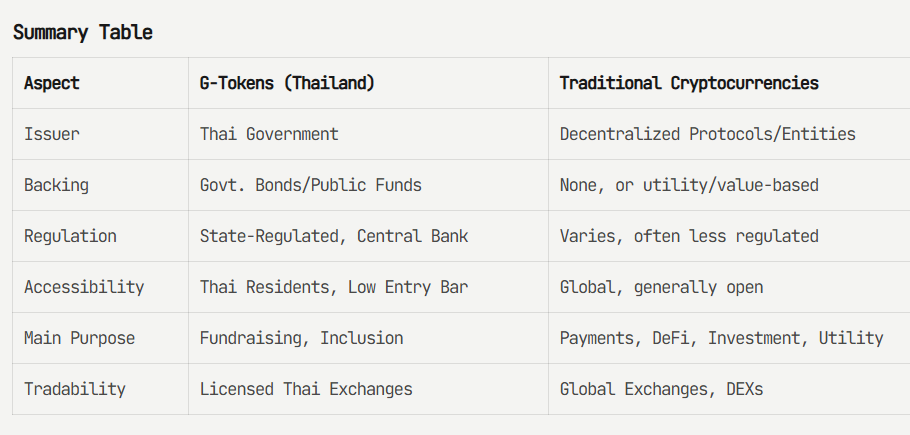

However, the ‘G-tokens’ are not considered to be a cryptocurrency. Let’s take a look at the difference between the two.

G-tokens — The Thai government issues them through the Ministry of Finance. They are digital investment tokens tied to government bonds. They aren’t classified as crypto. Furthermore, they’re also not considered to be debt instruments in legal terms.

Cryptocurrency — A decentralized digital asset that projects or protocols can mint. These are not backed by governments or any other assets.

Source: Alva

Furthermore, G-tokens are designed to raise government funds. They offer higher yield compared to bank deposits. The friendly entry price of only $3 is another reason for retail to get involved. Thailand also diversifies its fund-raising options by adding tokenized bonds. By adding blockchain technology, it also modernizes its public fundraising.

However, G-tokens are compliant with the Bank of Thailand’s digital asset rules. It’s also important to notice that they are explicitly mentioned as not being crypto. So, G-tokens vary in many ways from crypto assets. They tend to be much more decentralized but also have less regulation. You can only trade them on Thai exchanges and are not available to non-Thai residents. Crypto is available on exchanges around the world and available to almost anyone.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Thailand to Offer $3 Tokenized Bonds to Retail Investors appeared first on Altcoin Buzz.