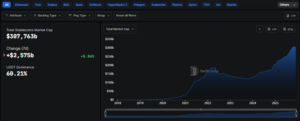

Hayes said the weakening of the Chinese yuan might push investors to move their money out of China.

According to Hayes, the Chinese government may devalue the yuan in response to economic pressures like slowing growth and rising debt. If that happens, Chinese businesses and wealthy individuals could look for ways to protect their assets. Is this a good news for Bitcoin?

Bitcoin Steps Up as a Safe Haven Amid Yuan Weakness

This kind of capital flight isn’t new. When citizens lose confidence in their local currency, they often search for more stable stores of value. Hayes pointed out that while gold has long been the go-to option, Bitcoin is now stepping up to the plate, especially for younger investors who are more tech-savvy and comfortable with digital assets.

With the rise of DeFi and peer-to-peer crypto exchanges, getting around those controls is becoming easier by the day. For those looking to protect their wealth quietly, Bitcoin offers a fast and private option — one that doesn’t rely on traditional banking systems.

If not the Fed then the PBOC will give us the yachtzee ingredients.

CNY deval = narrative that Chinese capital flight will flow into $BTC.

It worked in 2013 , 2015, and can work in 2025.

Ignore China at your own peril. pic.twitter.com/LAOeQZEjZt

— Arthur Hayes (@CryptoHayes) April 8, 2025

Hayes didn’t stop there. He said that if China does weaken the yuan, it could trigger a ripple effect in global markets. Investors everywhere might look at this as a sign to diversify away from fiat currencies and traditional assets.

More about Bitcoin

According to the CEO of 21st Capital, China’s currency devaluation is more than just an economic signal—it’s a trigger for change. Historically, when the yuan weakens, capital doesn’t just sit idly by—it moves, often finding its way into gold, foreign assets, and increasingly, Bitcoin.

China beginning currency devaluation is more than just an economic signal—it’s a trigger.

Historically, when the yuan weakens, capital doesn’t stay put. It escapes. Some of it flows into gold, some into foreign assets—and a meaningful slice finds its way into Bitcoin.

Now layer… pic.twitter.com/fhLyxXWzd3

— Sina

21st Capital (@Sina_21st) April 8, 2025

With rising tariffs, slowing global trade, and a growing lack of trust in traditional financial systems, the demand for neutral, borderless, and incorruptible assets is only growing. Bitcoin, once seen as a mere hedge, is now becoming a necessity for investors looking for stability beyond the control of any single nation. In an uncertain world, it’s emerging as a safe harbor for those seeking to protect their wealth.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post BitMEX’s CEO: Yuan Drop Could Boost Bitcoin appeared first on Altcoin Buzz.