Infrastructure projects never go out of style. And in the case of oracles, DeFi and RWA need them every second of every day.

Today, we’re comparing two major crypto infrastructure projects that are oracles: Peaq and Chainlink. Where would we go if we had to put $1000 in one of these high-potential projects?

These two are shaking up the space but in very different ways. Chainlink dominates oracles, providing real-world data to smart contracts. Peaq, on the other hand, is pioneering DePIN (Decentralized Physical Infrastructure Networks), where machines interact and transact without middlemen. So, which one is the better bet for the future? Let’s break it down

What They Do

Think of Chainlink as the bridge between blockchains and reality. It pulls in real-world data like crypto prices, weather reports, and sports scores so that smart contracts can execute accurately. Without Chainlink, most DeFi apps wouldn’t work properly. Protocols like Aave, Synthetix and MakerDAO depend on Chainlink’s data. So Chainlink is like the guy feeding data to most DeFi protocols.

Chainlink bridges blockchains with real-world data, powered by its native token, LINK.

– Chainlink’s decentralized oracles enable smart contracts to access off-chain data securely.

– LINK token fuels the network, compensating node operators and ensuring reliability.

-…— Bitcoin.com News (@BTCTN) March 18, 2025

Peaq

Peaq is not just another blockchain. It’s built for machines. I’m talking drones, EV chargers, delivery robots, and smart city infrastructure. Peaq gives these machines digital identities so they can autonomously trade, pay, and operate. It’s the backbone of the DePIN revolution. And with lots of AI Agent potential.

We’re excited to announce that we are adopting the @chainlink standard for onchain data and cross-chain connectivity as a secure way to bring DeFi into the next stage of mass adoption. https://t.co/KBJmSplT9e

— WLFI (@worldlibertyfi) November 14, 2024

Technology; How They Work

Chainlink’s Tech:

- Chainlink uses decentralized oracles to fetch off-chain data.

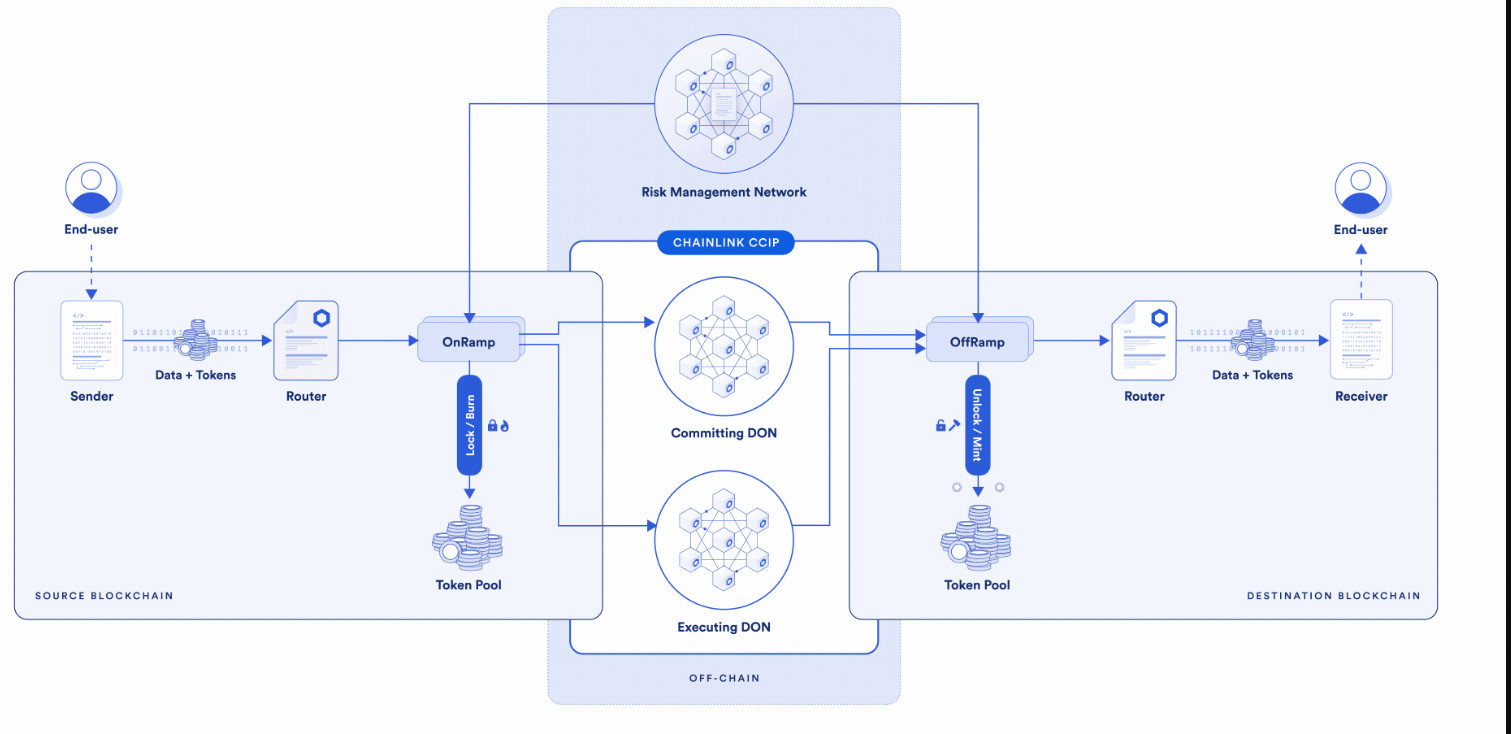

- It powers CCIP (Cross-Chain Interoperability Protocol) to connect different blockchains.

#Chainlink Data Streams is available on @solana mainnet, featuring @GMX_SOL as a launch partner.

Solana devs now have access to high-frequency, sub-second market data backed by Chainlink’s time-tested, decentralized infrastructure.#RoadToSmartCon pic.twitter.com/K4SS4TnYJn

— Chainlink (@chainlink) October 28, 2024

- Chainlink works with Ethereum, Solana, Polygon, and more. This shows it has massive network coverage

Peaq’s Tech:

- Peaq is a Layer-1 blockchain built on Substrate and part of Polkadot’s ecosystem.

- It uses Self-Sovereign Machine Identities (SSIs) so devices can own identities and trade autonomously.

- Peaq is optimized for low fees and machine-to-machine (M2M) payments.

So, while Chainlink focuses on bringing data to smart contracts, Peaq is creating an entire machine-powered economy.

Use Cases; Who Needs Them?

Chainlink has massive use cases across various sectors:

.@Ripple x @Chainlink: $RLUSD has adopted the Chainlink standard for verifiable data to fuel DeFi adoption with real-time, secure pricing data.

The future of stablecoins is here: https://t.co/mq3cThLGQJ pic.twitter.com/993Ac0o282

— Ripple (@Ripple) January 7, 2025

- DeFi: It powers Aave, MakerDAO, Synthetix, and more by providing price feeds.

- NFTs and Gaming: Uses VRF (Verifiable Random Function) to ensure fair randomness.

- Enterprises and Insurance: Helps real-world businesses integrate blockchain-secured data.

Over 50% of #DeFi is using or integrating #Chainlink. So Far. Bullish. $LINK pic.twitter.com/GtfTD1EeJX

— Jen

(@Here2DeFi) May 28, 2021

(@Here2DeFi) May 28, 2021 - Supply Chain: Chainlink can help handle bills of lading, customs clearance, etc.

Peaq is changing industries like:

- EV Charging Networks: Direct crypto payments without middlemen.

State of the peaqosystem

September 2024 pic.twitter.com/jUapsflLtm

— peaq (@peaq) September 30, 2024

- Smart Cities: Drones delivering packages autonomously, IoT-powered traffic systems.

- DePIN Ecosystem: Powering machine economies where AI, robots, and smart devices trade seamlessly.

Chainlink dominates financial data; Peaq is bringing crypto to the physical world.

Tokenomics: $LINK vs. $PEAQ

$LINK token:

The $LINK token powers the Chainlink ecosystem with a well-defined use case:

- $LINK is used to pay oracle nodes and secure the network.

- Demand comes from DeFi, gaming, and enterprises.

- Has a max supply of 1 billion LINK.

$PEAQ Token:

$PEAQ is at the core of the Peaq blockchain. Here’s what it does:

- Transaction fees: Machines, vehicles, and sensors generate millions of transactions.

Industry Map

DePINs on peaq are reshaping 22 industries

The engine of the Machine Economy is starting up pic.twitter.com/zdr0pVGYlS

— peaq (@peaq) March 17, 2025

- Staking system: Peaq relies on Collators and Delegators for block production. A slashing mechanism keeps validators honest.

- Governance: Holding $PEAQ lets users vote on major network decisions.

- Reputation system: Machine owners can stake $PEAQ to guarantee trustworthiness.

- Tokenomics: $PEAQ has a max supply of 4.2 billion with a disinflationary model. This starts at 3.5% inflation, decreasing 10% annually until stabilizing at 1%. However, with less than 20% of its tokens in circulation, big supply unlocks could be a drag on price.

LINK is already established in crypto markets; PEAQ is built for future machine economies.

Adoption and Partnerships

- Chainlink

Hundreds of projects use Chainlink’s services, including SWIFT, Microsoft, Brazil’s Central Bank, Vodafone, and CoinGecko.

Chainlink is the cornerstone of blockchain innovation, connecting the dots between technology and real-world solutions! $LINK powers real-world solutions across multiple industries:

1⃣ #DeFi Dominance: Over $12B in total value secured through Chainlink oracles.

2⃣ AI &… pic.twitter.com/D8HYoMBFAi

— ⬡ The Crypto Panda ⬡ (@TheLinkPanda) January 27, 2025

Chainlink isn’t just for crypto. It’s also bridging the gap between TradFi (traditional finance) and blockchain.

We’re excited to announce that Brazil’s central bank @BancoCentralBR is using Chainlink in its CBDC project, alongside @Microsoft (@msPartner), @interbr, & 7COMm.

CCIP enables cross-currency, cross-border, cross-chain transactions to be settled securely

https://t.co/7aBGtHh3mt

— Chainlink (@chainlink) November 19, 2024

- Peaq

Peaq is already one of the fastest-growing DePIN ecosystems in the world. Just look at the numbers:

- 1,000,000+ machines, vehicles, robots, and devices are live on the network.

- $25M+ in tokenized Machine Real-World Assets (RWAs).

- 45+ DePINs are currently building on Peaq.

- Over 20 industries are being transformed by Peaq’s technology.

Chainlink TradFi Use Cases

Selling tokenized bonds on a private chain.

Buying with a euro-backed stablecoin on a public chain.Made possible by Chainlink. pic.twitter.com/TvsE7152Tm

— Chainlink (@chainlink) January 26, 2025

A key reason for Peaq’s rapid growth is strategic partnerships. For example, Bosch, the world’s largest sensor manufacturer, is a key partner. DePINs need sensors. So, this partnership puts Peaq at the heart of the industry.

peaq has secured $20 million in the largest @CoinList launch in 2+ years

Over 14,500 community members contributed over $36 million to oversubscribe peaq’s token launch on @CoinList, making it both the largest raise and the launch with the highest amount of contributed funds… pic.twitter.com/ztAmbllbFC

— peaq (@peaq) May 16, 2024

However, Chainlink is already everywhere in DeFi. Peaq is still growing but has a unique niche.

We’re thrilled to welcome Bosch, the world’s largest sensor manufacturer, to #DePIN

The @BoschGlobal XDK is capable of offering services via 8 types of DePIN using @Fetch_ai #AI Agents.

A giant step towards peaq-ready DePIN hardware. pic.twitter.com/PPqD5XcFbc

— peaq (@peaq) December 7, 2023

The Verdict: Which One Wins?

If you want an established infrastructure player, Chainlink is your go-to. It secures billions in DeFi, is trusted by major enterprises, and is a blue-chip in crypto.

$LINK@chainlink is a decentralized oracle network that enables blockchain platforms to securely interact with external data.

– Sector: Infrastructure

– Price: $13.51

– Market Cap: $8.87B pic.twitter.com/hdaDbRHY48— DANNY (@Danny_Crypton) March 18, 2025

If you believe in DePIN and the machine economy, Peaq is your bet. It’s early-stage but promising, with big partnerships and a unique use case.

The addressable market size for DePin Networks will reach 3.2 Trillion Dollars by 2028.

The current market cap of DePIN Projects is around $32B.

The DePIN sector offers a 100x opportunity for builders and investors.

Let’s deep dive into the crazy world of DePIN

— hitesh.eth (@hmalviya9) January 8, 2024

Both projects have strong potential, but they serve different markets. Chainlink secures DeFi and enterprise data, while Peaq could be the Ethereum of smart devices. Which one do you think will see the biggest adoption first? Let me know your thoughts in the comments

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted risk tolerance levels of the writer/reviewers, and their risk tolerance may differ from yours. We are not responsible for any losses you may incur due to any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Chainlink vs Peaq – Where to Invest $1000 for Big Crypto gain? appeared first on Altcoin Buzz.